This Week in Cryptocurrency / The (My) Case for Algorand

There's no ignoring the rapid advancement and public acceptance of Decentralized Finance (DeFi) and Cryptocurrency. Just one week preceding this post (02/08/2021) we saw Tesla add $1.5 Billion of Bitcoin to their balance sheet and announce that they will begin accepting bitcoin (and other cryptos) as payment.(1)

Two days later (02/10/2021) we saw MasterCard announce that in 2021, they will "start supporting select cryptocurrencies directly on [their] network." They do admit that this will be a process requiring regulation and research to ensure MasterCard's compliance measures are met. However, MasterCard does specifically mention stablecoins ("cryptocurrencies that attempt to peg their market value to some external reference(2) - such as the USD" as the implementation they "expect to bring into [their] network"(3). I will come back to why this is important.

In further MasterCard news two days later, (02/12/2021) we saw an announcement that Apple Pay users would be able to, effective immediately, add their BitPay prepaid MasterCards to their Apple Wallets for online and in-store payments.(4,5)

Keep in mind that Visa and PayPal have already been in the crypto space and working with popular wallets like Coinbase and others.

The way I see it, each major player entering the Cryptocurrency space creates a "space race" to see who can achieve success first in this paradigm shift. This means serious financial opportunity for all. It goes without saying that due diligence and proper vetting must be done. That's what brings me to the main topic here: Algorand.

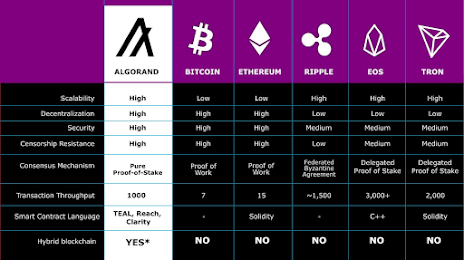

Algorand is a blockchain protocol (The Algorand Protocol) that solves a problem referred to as the "blockchain trilemma." Blockchain trilemma can be easily understood as a scenario where there are three total goals and only two goals can be accomplished at the same time. (scalability, security and decentralization). Algorand, however, is a pure "proof of stake" protocol whereas all three of the previously-described functions are achievable in verifying blockchain transactions. This is done by a method called a "proof of stake" consensus whereas a user's influence on the building and verifying of a transaction on the Algorand blockchain is directly proportional to the number of Algorand units one holds. As a reward for holding Algorand units, users are awarded compounded interest between 6% and 8% of their stake for helping further the blockchain. In other words, users have a randomized and handsomely lucrative incentive to hold Algorand units to verify transactions. The alternative to "proof of stake" is "proof of work" or the consensus Bitcoin uses, whereas supercomputers compete against each other using lots of energy and resources to find the next block/solution to the blockchain. Proof of stake keeps the power in the hands at random of token holders and is not susceptible to influence.

If you made it this far, you may roughly understand what Algorand is and how it is different than other blockchains. More important than all of that is how this protocol can actually be used. In my opinion, there are not enough resources out there that put functionality into plain words so I will try and do that here with a payments example.

You go to Starbucks, order your drink and present your credit card to pay for your purchase. You swipe or insert your credit card into the point of sale terminal, wait a few seconds, and the transaction is "complete." You wait for your drink and then go. However, the transaction is not actually done yet. The point of sale terminal is still facilitating many other steps to verify the transaction that just took place (purchased your starbucks drink). In reality, there are many more steps in this verification process such as verifying the transaction with the merchant's bank, your own bank, a payments gateway, card association, etc. There are many areas for things to go wrong, transactions to fail and for fraud to occur. I'm sure we all have stories of our cards getting swiped somewhere without our authorization.

Lastly, there are fees involved. Think about your favorite local pizza shop that doesn't accept credit cards from "X" network. This is because that shop probably has agreements with network "Y" since they have a deal on less fees with network "Y."

Here's where Algorand comes in:

(Disclaimer - this next section is entirely speculation and should be - like anything else I've written - taken with a grain of salt).

Algorand is one step away from integration with a major company to create the next step in financial decentralization, scalability and security. With a little digging, you may have already found a little hint of what I suspect is coming: An integration with MasterCard and/or PayPal/others.

I mentioned before that MasterCard states they are primarily interested in stablecoins. It just so happens that USDC, a Coinbase stablecoin (the main exchange Algorand is traded on - currently sitting at #12 in popularity) is the first stablecoin brought onto Algorand's blockchain(6).

Further, a Brazilian stablecoin called BRZ(7) launched on Algorand's blockchain in November of last year, as well as additional other Latin-American stablecoins this month. As more and more days go by, it is not unreasonable to speculate that more and more stablecoins will be added into the Algorand blockchain.

One last breadcrumb I will leave here is a link to a PDF by the Digital Monetary Institute on the "Future of Payments." Conveniently, on page 1, we can see that Algorand, Mastercard, PayPal and others already appear to be working with each other. Further, 2021 MIT Fintech Conference set to take place on March 5 2021 will feature many speakers such as Mastercard CEO Ajay Banga and Coinbase CPO Surojit Chatterjee amongst many others.

As of the time of this post, Algorand sits at $1.43 a coin with a market cap of $2.3 Billion and circulating supply of $1.6 Billion and trading activity of 60% buy 40% sell. I expect another day of small correction (US Holiday on Monday) and then an uptick on Tuesday when the work week starts back up. I also expect some more big crypto news this week, so I am HODLing. Keep in mind, all the Algorand growth to this point has been organic and without any media influence. I expect the influence to come in VERY soon.

**Edit: Yes, every crypto seemingly crashed momentarily after this post in what looked like a coordinated effort. Just about everything dipped. HODL and wait for the news cycle this week!

*I am not associated in any official capacity with Algorand or anyone connected with it in any way. Thoughts are my own or are cited below. This is not financial advice and is meant for entertainment and educational purposes only.

All opinions, ideas and viewpoints expressed here are mine and do not reflect those of my employer.

https://www.algorand.com/the-future-of-payments.pdf

https://www.mitfintech.com/speakers

Citations:

Ostroff, Caitlin, and Rebecca Elliott. “Tesla Buys $1.5 Billion in Bitcoin.” The Wall Street Journal, Dow Jones & Company, 8 Feb. 2021, www.wsj.com/articles/tesla-buys-1-5-billion-in-bitcoin-11612791688.

Hayes, Adam. “Stablecoin.” Investopedia, Investopedia, 23 Nov. 2020, www.investopedia.com/terms/s/stablecoin.asp.

“Why Mastercard Is Bringing Crypto onto Its Network.” Mastercard USA, www.mastercard.com/news/perspectives/2021/why-mastercard-is-bringing-crypto-onto-our-network/.

Reichert, Corinne. “Apple Pay Can Now Be Used to Spend Bitcoin.” CNET, CNET, 13 Feb. 2021, www.cnet.com/news/apple-pay-can-now-be-used-to-spend-bitcoin/.

Crawley, Jamie. “Crypto Payments Provider BitPay Adds Apple Pay Support.” CoinDesk, CoinDesk, 12 Feb. 2021, www.coindesk.com/crypto-payments-provider-bitpay-adds-apple-pay- support.

Kalra, Jaspreet. “Circle, Coinbase Bring USDC Stablecoin to Algorand's Blockchain.” CoinDesk, CoinDesk, 26 June 2020, www.coindesk.com/circle-coinbase-bring-usdc-stablecoin-to-algorands-blockchain.

“BRZ Launches on Algorand Blockchain.” Panoramacrypto.com, 11 Feb. 2021, panoramacrypto.com/brz-launches-on-algorand-blockchain/.

Comments

Post a Comment